Date: 24/06/2025 | Written By: Business credit score improvement

Lightbulb is uniquely placed to help and support businesses to understand, improve and monitor how they are rated by all of the UK’s main credit rating agencies and trade credit insurers.

This supports businesses with optimising or mitigating risks in relation to their working capital, improving their liquidity, accessing finance and helping them understand the wider impacts of their trade credit ratings.

Lightbulb work with the main UK credit rating agencies, being Creditsafe, Experian, Equifax, Dun & Bradstreet, and Red Flag Alert. They can also facilitate data from and into the trade credit insurance market. Lightbulb has a unique ability to provide a whole market view of your business rapidly and without impacting its credit file.

Following the initial Credit Insight report, Lightbulb can leverage their exclusive partnerships where needed provide each credit agency with a better understanding of your business’s financial circumstances, allowing you to review and improve your business credit rating(s) or limit(s).

Credit ratings have become increasingly important for businesses who are:

1. Wanting to understand and improve their supplier terms and working capital

2. Seeking funding, either now or in the near future

3. Tendering for work and to win new contracts.

Key Services

Credit Insight

Lightbulb’s unique business credit insights report is the starting point to understanding how the UK credit agencies view your business. Each agency can and often does rate the same business differently based on their own algorithms and data suppliers, making it important to see each element of our consolidated report.

Lightbulb simplify this for clients, pulling all this data into one document and sharing it. Plus, their team of experts are on hand to walk through the insights and impact this could be having now or in the future.

Credit Improvement

If the Credit Insight reports highlights that your business’s trade credit ratings or limits have been impacted, you are about to file information that could negatively impact the ratings and limits - Lightbulb can support you.

Lightbulbs Credit Insight report does not impact your business in any way. Their improvement work is completed under NDA’s and none of the data shared about your company will be in the public domain – this is part of their unique and valuables suite of services.

Credit Monitoring

Lightbulb also provide ongoing insights and expert assistance that are essential for maintaining and improving your business’s credit profile through their credit monitoring portal. The portal provides users with:

Real-Time Credit Monitoring: A live view of how key credit agencies, including Experian, Equifax, D&B, and Creditsafe, assess your business. This keeps you informed of any changes to your credit profile as they happen.

Monthly Credit Updates: Detailed reports delivered monthly to keep you up-to-date on the credit standing across multiple credit bureaus.

Alerts for Key Changes: Immediate alerts whenever there are changes to your business's credit profile, allowing you to respond quickly.

Dedicated Team Support: Their expert team is on hand to provide guidance, answer questions, and offer strategic advice to help you manage and improve your business creditworthiness.

This service provides peace of mind by ensuring that your business’s credit profile is continually monitored, and any potential issues are identified early on.

How can Lightbulb impact results

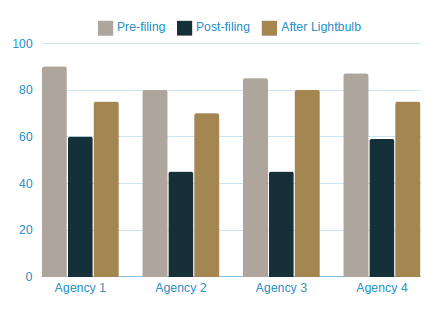

In the example you can see the impact of filing business accounts has had on credit ratings. The business had made changes at board level, impacting ratings and their chance of tendering for government contracts. Lightbulb used their exclusive partnerships, to provide more context of changes, which encouraged the agencies to update ratings. This resulted in very similar pre-filing ratings.

Benefits for you

+ Understand and improve suppliers credit terms through credit insight reports.

+ Improve liquidity and working capital by improving supplier terms

+ Manage working capital risk / Optimise working capital

+ Lightbulb will work with you to try and mitigate losses, risks to supplier terms, or optimise these depending on how your business is rated

+ Improve tendering abilities. Businesses can win more work when credit ratings are used in contracting processes

+ Real time credit monitoring. Always be on the front foot with changes to credit profiles

+ Scenario work enables you to advise on the impact of financial decisions

+ Clarity and support on special solutions such as pre-packs, carve-outs, debt for equity swaps, balance sheet recapitalisation and material uncertainties

To find out more, click here

Keep up to date with the latest news, updates, expert opinions and events specifically for Advisers.

Interested to understand how Practice Portfolio could benefit you and your clients?